A recent insurance study revealed that a large majority of drivers kept buying from the same company for a minimum of four years, and nearly the majority have never quoted rates to find affordable coverage. California insurance shoppers could save roughly 35% a year just by comparing rates, but they won’t spend time to find affordable insurance rates.

Truthfully, the best way to get more affordable car insurance rates in Chula Vista is to start doing a yearly price comparison from providers who sell insurance in California. Prices can be compared by following these guidelines.

Truthfully, the best way to get more affordable car insurance rates in Chula Vista is to start doing a yearly price comparison from providers who sell insurance in California. Prices can be compared by following these guidelines.

- First, read and learn about how insurance works and the things you can control to prevent rate increases. Many rating criteria that result in higher rates like your driving record and an imperfect credit score can be eliminated by making minor changes to your lifestyle. Later in this article we will cover more information to get affordable coverage and find missing discounts.

- Second, compare rates from direct carriers, independent agents, and exclusive agents. Exclusive and direct companies can only give prices from a single company like Progressive or State Farm, while agents who are independent can provide prices for a wide range of insurance providers. Compare rates

- Third, compare the new rate quotes to your existing coverage to see if a cheaper price is available. If you find a better price and change companies, make sure the effective date of the new policy is the same as the expiration date of the old one.

- Fourth, tell your current company to cancel your current car insurance policy and submit a down payment along with a signed application to your new company or agent. Make sure you keep your new proof of insurance paperwork in an easily accessible location in your vehicle.

One bit of advice is that you use the same level of coverage on each quote request and and to get price quotes from all possible companies. This helps ensure the most accurate price comparison and the best price selection.

If you have a policy now or just want cheaper rates, you will benefit by learning to reduce the price you pay and still have adequate protection. Locating the most cost-effective insurance policy in Chula Vista can be made easier if you know where to look. Smart shoppers just have to understand the fastest way to shop from many companies at once.

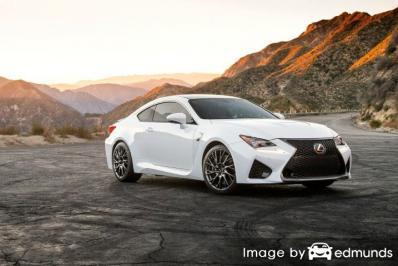

Best Lexus RC F insurance prices in California

The providers in the list below can provide quotes in California. To find cheap car insurance in California, we recommend you visit several of them to get a more complete price comparison.

Get Lexus RC F Insurance at a Discount

Many factors are part of the calculation when you quote your car insurance policy. Some factors are common sense such as traffic violations, although others are less apparent like your vehicle usage and annual miles driven.

Listed below are a few of the “ingredients” that factor into your premiums.

The higher your credit rating the lower your rates – Your credit history will be a significant factor in calculating your premium rate. If your credit history leaves room for improvement, you could pay less to insure your Lexus RC F if you clean up your credit. People that have excellent credit scores tend to be better risks to insure as compared to drivers with bad credit.

Low mileage costs less – The more miles you rack up on your Lexus every year the higher your rate. The majority of insurers calculate prices determined by how the vehicle is used. Cars that do not get driven very much can get a lower rate as compared to vehicles used primarily for driving to work. It’s a smart idea to ensure your car insurance declarations sheet properly reflects how each vehicle is driven. Having the wrong rating on your RC F may be costing you higher rates.

Costs impacted by your city – Choosing to live in less populated areas of the country may provide you with better prices when talking about car insurance. Lower population means less chance of accidents in addition to lower liability claims. People who live in big cities regularly have traffic congestion and more severe claims. The longer drive time means higher likelihood of an accident.

When should you not file claims? – Insurance companies in California award most affordable rates to insureds who do not file claims often. If you frequently file small claims, you can definitely plan on higher premiums or even policy non-renewal. Insurance coverage is intended for claims that you cannot pay yourself.

Decrease premiums by maintaining coverage – Driving without insurance coverage in place can get you a ticket and you will pay a penalty because you let your insurance expire. Not only will you pay higher rates, failure to provide proof of insurance could earn you a hefty fine and possibly a revoked license.

Take policy discounts and save on Lexus RC F insurance in Chula Vista

Companies offering auto insurance don’t always publicize all possible discounts in an easy-to-find place, so the list below details both the well known and also the lesser-known credits available to lower your premiums when you buy Chula Vista car insurance online. If you aren’t receiving every discount you qualify for, you are not getting the best rate possible.

- Active Service Discounts – Having a family member in the military could be rewarded with lower insurance rates.

- Discount for Good Grades – Getting good grades can save 20 to 25%. Many companies even apply the discount to college students until age 25.

- Theft Prevention System – Vehicles equipped with tracking devices and advanced anti-theft systems can help prevent theft and earn discounts up to 10% off your Chula Vista car insurance quote.

- Home Ownership Discount – Simply owning a home can save you money because it shows financial diligence.

- Payment Method – If you pay your entire premium ahead of time rather than paying in monthly installments you may reduce your total bill.

- Professional Organizations – Being in a qualifying organization is a simple method to lower premiums on insurance.

- Government Employees – Federal government employees could cut as much as 10% off depending on your company.

- Driving Data Discount – Chula Vista drivers who agree to allow data collection to monitor their driving habits by using a telematics device such as Progressive’s Snapshot may get a rate reduction as long as they are good drivers.

- Distant College Student Discount – Children who are enrolled in higher education away from home and do not take a car to college may qualify for this discount.

- Sign Online – Some insurance companies will provide an incentive get Chula Vista car insurance online.

Drivers should understand that most credits do not apply to the entire policy premium. A few only apply to specific coverage prices like collision or personal injury protection. If you do the math and it seems like you could get a free insurance policy, companies wouldn’t make money that way. But all discounts will positively reduce your policy premium.

A partial list of companies that possibly offer most of the discounts above include:

Before you buy a policy, ask each company which discounts you qualify for. All car insurance discounts may not apply to policyholders everywhere. To choose insurers who offer online Lexus RC F insurance quotes in Chula Vista, click this link.

Insurance is available from local agents

A small number of people would rather buy from a licensed agent and doing that can be a smart decision Good agents can make sure you are properly covered and help in the event of a claim. A nice benefit of comparing rates online is the fact that drivers can get the best rates and also buy local.

To make it easy to find an agent, after completing this quick form, the coverage information is immediately sent to agents in your area who will give you bids for your coverage. It’s much easier because you don’t need to search for any insurance agencies since rate quotes are delivered instantly to you. If you have a need to compare rates from a specific insurance provider, just jump over to their website and fill out the quote form the provide.

Picking an insurer should include more criteria than just a cheap quote. The following questions are important to ask.

- Has the agent ever had any license suspensions?

- Do they specialize in personal lines auto insurance in Chula Vista?

- Will the agent help in case of a claim?

- Do they have advanced training designations such as CPCU, AAI, AIC, or CIC?

- Which companies can they place coverage with?

- How experienced are they in personal risk management?

If you are wanting to find a reliable insurance agent, you need to know there are two different types of agencies and how they are slightly different. Agencies in Chula Vista are considered either exclusive or independent agents depending on their company appointments. Both types can write policy coverage, but it’s worth learning the difference in how they write coverage since it could factor into which agent you choose.

Exclusive Agencies

Agents that choose to be exclusive can only provide pricing for a single company such as AAA, State Farm, Farmers Insurance, and Allstate. These agents are unable to place coverage with different providers so they have to upsell other benefits. Exclusive agents are usually quite knowledgeable on what they offer which helps them sell insurance even at higher premiums.

Shown below is a list of exclusive agencies in Chula Vista that can give you rate quotes.

State Farm: Danny Patel

345 F St #160 – Chula Vista, CA 91910 – (619) 426-8352 – View Map

Allstate Insurance: Barry L. St. Onge

651 3rd Ave a – Chula Vista, CA 91910 – (619) 426-7885 – View Map

Lee Meyer – State Farm Insurance Agent

826 Starboard St – Chula Vista, CA 91914 – (619) 656-5020 – View Map

Independent Agencies or Brokers

Agents in the independent channel are not limited to a single company so as a result can place your coverage with any number of different companies and find you the best rates. If they quote lower rates, they can switch companies in-house and you don’t have to find a new agent. When shopping rates, we recommend you contact several independent insurance agents in order to have the best price comparison.

Shown below are independent agencies in Chula Vista that are able to give comparison quotes.

La Rosa Insurance Agency

1152 Third Ave – Chula Vista, CA 91911 – (619) 427-5950 – View Map

Fletes Insurance and Financial Services

2127 Olympic Pkwy #1006 – Chula Vista, CA 91915 – (619) 616-0037 – View Map

Adriana’s Insurance Services

1090 3rd Ave #5 – Chula Vista, CA 91911 – (619) 591-1540 – View Map

Auto insurance can be complex

When it comes to buying adequate coverage for your personal vehicles, there really isn’t a best way to insure your cars. Everyone’s needs are different.

Here are some questions about coverages that can aid in determining whether you will benefit from professional help.

- Why is insurance for a teen driver so high in Chula Vista?

- What is an SR-22 filing?

- If I use my vehicle for business use is it covered?

- Am I covered when driving a rental car?

- Is business property covered if stolen from my car?

- Is my teenager covered with friends in the car?

- What companies insure drivers after a DUI or DWI?

- What is the premium to book value ratio for dropping full coverage?

- I have a DUI can I still get coverage?

If it’s difficult to answer those questions but you think they might apply to your situation, then you may want to think about talking to a licensed agent. To find lower rates from a local agent, take a second and complete this form. It’s fast, free and may give you better protection.

A conclusion for your auto insurance search

Drivers leave their current company for many reasons like delays in responding to claim requests, high prices, delays in paying claims and questionable increases in premium. Regardless of your reason, choosing a new company is easier than you think.

We just presented many tips how you can get a better price on Lexus RC F insurance in Chula Vista. The key concept to understand is the more price quotes you have, the higher your chance of finding cheaper Chula Vista car insurance quotes. Consumers may even find the lowest prices are with a small mutual company.

Affordable Lexus RC F insurance in Chula Vista can be bought both online in addition to many Chula Vista insurance agents, and you should compare rates from both in order to have the best chance of saving money. Some insurance companies don’t offer online price quotes and usually these regional insurance providers provide coverage only through local independent agencies.

More articles

- Drunk Driving Statistics (Insurance Information Institute)

- Who Has Cheap Auto Insurance Quotes for a Toyota Highlander in Chula Vista? (FAQ)

- Who Has Cheap Chula Vista Auto Insurance for a Honda Civic? (FAQ)

- Who Has Cheap Auto Insurance Rates for a 20 Year Old Female in Chula Vista? (FAQ)

- Which Company has the Cheapest Car Insurance in Chula Vista, CA? (FAQ)

- Who Has the Cheapest Chula Vista Auto Insurance Rates for a Toyota Tacoma? (FAQ)

- Alcohol Impaired Driving FAQ (iihs.org)

- Your Car has been Stolen: Now What? (Allstate)