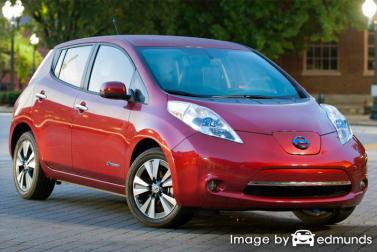

It takes a little time, but the best way to get more affordable Nissan Leaf insurance in Chula Vista is to do an annual price comparison from different companies in California.

It takes a little time, but the best way to get more affordable Nissan Leaf insurance in Chula Vista is to do an annual price comparison from different companies in California.

- Try to learn a little about how companies price auto insurance and the factors you can control to keep rates down. Many rating criteria that drive up the price such as traffic violations, accidents, and a poor credit rating can be improved by making minor driving habit or lifestyle changes. This article gives additional tips to help keep rates affordable and get discounts that may be overlooked.

- Compare prices from direct, independent, and exclusive agents. Exclusive and direct companies can provide rates from a single company like GEICO or Farmers Insurance, while independent agents can quote rates for a wide range of insurance providers. Compare rates

- Compare the new rates to your existing policy and see if there is a cheaper rate in Chula Vista. If you find a lower rate and decide to switch, make sure there is no lapse between the expiration of your current policy and the new one.

The key thing to know about shopping around is to use similar deductibles and liability limits on every quote and and to look at as many companies as you can. This provides a level playing field and the best rate selection.

It’s easy to assume that auto insurance companies don’t want you to look for cheaper rates. Insureds who shop around for cheaper prices are very likely to switch to a new company because there is a good chance of finding discount prices. A recent survey discovered that drivers who shopped around annually saved about $70 a month compared to those who never shopped around for lower prices.

If saving the most money on Nissan Leaf insurance is why you’re here, then having some insight into how to get rate quotes and compare cheaper coverage can save time, money, and frustration.

Buy Chula Vista Nissan Leaf insurance online

Just remember that comparing more quotes will increase your chances of finding better pricing. Not every company does online price quotes, so it’s necessary to compare price estimates from them as well.

The providers in the list below are our best choices to provide free rate quotes in Chula Vista, CA. To buy the best cheap car insurance in California, we recommend you visit several of them to find the most affordable auto insurance rates.

It may be expensive, but it’s not optional

Despite the high insurance cost for a Nissan Leaf in Chula Vista, buying auto insurance is required by state law in California and it also provides benefits you may not be aware of.

- Most states have minimum liability requirements which means state laws require a specific minimum amount of liability in order to be legal. In California these limits are 15/30/5 which means you must have $15,000 of bodily injury coverage per person, $30,000 of bodily injury coverage per accident, and $5,000 of property damage coverage.

- If you took out a loan on your Nissan Leaf, most lenders will make it mandatory that you have comprehensive coverage to ensure they get paid if you total the vehicle. If coverage lapses or is canceled, the bank or lender will purchase a policy for your Nissan at a much higher rate and force you to reimburse them for it.

- Insurance safeguards both your assets and your car. It will also provide coverage for most medical and hospital costs incurred in an accident. One policy coverage, liability insurance, will also pay to defend you if you are named as a defendant in an auto accident. If your Nissan gets damaged, collision and comprehensive coverages will pay to have it repaired.

The benefits of having auto insurance definitely exceed the cost, especially with large liability claims. The average driver in America overpays as much as $800 each year so it’s recommended you shop around at every renewal to save money.

Save money on Nissan Leaf insurance in Chula Vista with these eight discounts

Companies that sell car insurance don’t necessarily list every discount very well, so the list below contains some of the more common as well as the least known savings tricks you should be using when you buy Chula Vista car insurance online.

- Paperwork-free – Some of the larger companies provide a small discount simply for signing on their website.

- No Accidents – Good drivers with no accidents can earn big discounts as compared to bad drivers.

- Telematics Data Discounts – Policyholders that allow driving data submission to monitor driving habits by installing a telematics device such as Progressive’s Snapshot and State Farm’s In-Drive may see discounts if they have good driving habits.

- Passive Restraints and Air Bags – Vehicles equipped with air bags could see savings of 20% or more.

- Drive Less and Save – Low annual miles could be rewarded with slightly better car insurance rates than normal.

- Driver Education Discount – Reduce the cost of insurance for teen drivers by having them complete a driver education course in school.

- Life Insurance – If the company offers life insurance, you could get a discount if you purchase some life insurance in addition to your auto policy.

- College Student – Older children who attend college more than 100 miles from Chula Vista and leave their car at home may be insured at a cheaper rate.

It’s important to note that most credits do not apply to your bottom line cost. Some only apply to individual premiums such as comprehensive or collision. So even though you would think all those discounts means the company will pay you, you’re out of luck.

To locate insurers with discount rates in California, click here to view.

Local Chula Vista car insurance agents and auto insurance

Some consumers still like to sit down and talk to an agent and doing that can be a smart decision An additional benefit of comparing rates online is the fact that drivers can get cheap rate quotes and still have a local agent.

After filling out this simple form, your insurance coverage information is emailed to local insurance agents in Chula Vista that can give you free Chula Vista car insurance quotes for your coverage. It makes it easy because there is no need to contact any agents as quotes are delivered to you. It’s the lowest rates AND a local agent. If you need to quote rates for a specific company, you just need to go to their quote page and give them your coverage information.

Selecting an insurer is decision based upon more than just the price. Any good agent in Chula Vista should know the answers to these questions.

- In the event of vehicle damage, can you pick the collision repair facility?

- Do they carry Errors and Omissions coverage?

- Is the agent properly licensed in California?

- Does the agent have professional designations like CIC, CPCU or AIC?

- Will the agent or a CSR service your policy?

- Will they take your side in the event of a claim?

Two types of Chula Vista car insurance agents

When researching a good insurance agency, you need to know there are two types of insurance agents and how they are distinctly different. Insurance agencies in Chula Vista can be described as either independent agents or exclusive agents.

Exclusive Agencies

Exclusive agencies have only one company to place business with such as State Farm, AAA, and Liberty Mutual. Exclusive agents are unable to shop your coverage around so it’s a take it or leave it situation. They are well trained on the products they sell and that allows them to sell at a higher price point.

Shown below are Chula Vista exclusive insurance agents who may provide you with rate quotes.

State Farm: Danny Patel

345 F St #160 – Chula Vista, CA 91910 – (619) 426-8352 – View Map

Farmers Insurance: Vega Julio V

799 Third Ave – Chula Vista, CA 91911 – (619) 426-0554 – View Map

Farmers Insurance – Francisco Moreno

2471 Main St #19 – Chula Vista, CA 91911 – (619) 476-1066 – View Map

Independent Auto Insurance Agents

Independent insurance agents often have many company appointments and that is an advantage because they can write policies through many different auto insurance companies and possibly get better coverage at lower prices. If they find a lower price, your policy is moved internally and that require little work on your part.

When comparing rate quotes, you absolutely need to get rate quotes from several independent insurance agents so that you have a good selection of quotes to compare.

Below is a short list of independent insurance agents in Chula Vista that can give you price quotes.

Eastlake Insurance Services

884 Eastlake Pkwy # 1626 – Chula Vista, CA 91914 – (619) 216-6100 – View Map

Fred Loya Insurance

1177 Broadway STE 21 – Chula Vista, CA 91911 – (619) 422-7500 – View Map

Princell Insurance Services

1068 Moonstone Pl – Chula Vista, CA 91913 – (619) 397-5955 – View Map

Upon receiving acceptable answers for all questions you ask as well as an affordable premium quote, chances are good that you have found an insurance agent that is reliable enough to adequately provide auto insurance.

Best auto insurance in Chula Vista

Buying coverage from a high-quality auto insurance provider is hard considering how many different companies sell coverage in Chula Vista. The information shown next may help you decide which car insurance providers you want to consider comparing prices from.

Top 10 Chula Vista Car Insurance Companies Ranked by Customer Service

- AAA of Southern California

- GEICO

- State Farm

- The Hartford

- Mercury Insurance

- The General

- Progressive

- Allstate

- AAA Insurance

- American Family

Top 10 Chula Vista Car Insurance Companies Ranked by Value

- USAA

- American Family

- The Hartford

- AAA of Southern California

- Titan Insurance

- The General

- AAA Insurance

- State Farm

- Mercury Insurance

- Nationwide

Learn about insurance coverages for a Nissan Leaf

Learning about specific coverages of your insurance policy aids in choosing appropriate coverage for your vehicles. The terms used in a policy can be confusing and even agents have difficulty translating policy wording. These are typical coverages found on the average insurance policy.

Comprehensive protection

This coverage pays to fix your vehicle from damage OTHER than collision with another vehicle or object. You need to pay your deductible first and the remainder of the damage will be paid by comprehensive coverage.

Comprehensive coverage protects against claims such as vandalism, a broken windshield and damage from a tornado or hurricane. The maximum amount you can receive from a comprehensive claim is the ACV or actual cash value, so if your deductible is as high as the vehicle’s value it’s not worth carrying full coverage.

Uninsured or underinsured coverage

Your UM/UIM coverage gives you protection from other drivers when they are uninsured or don’t have enough coverage. Covered claims include medical payments for you and your occupants and also any damage incurred to your Nissan Leaf.

Due to the fact that many California drivers only purchase the least amount of liability that is required (15/30/5), their limits can quickly be used up. That’s why carrying high Uninsured/Underinsured Motorist coverage should not be overlooked.

Medical expense coverage

Coverage for medical payments and/or PIP provide coverage for short-term medical expenses for ambulance fees, chiropractic care, pain medications and X-ray expenses. They are used to fill the gap from your health insurance policy or if you lack health insurance entirely. It covers not only the driver but also the vehicle occupants in addition to any family member struck as a pedestrian. PIP coverage is not an option in every state but it provides additional coverages not offered by medical payments coverage

Auto collision coverage

This coverage pays to fix your vehicle from damage resulting from colliding with an object or car. You have to pay a deductible and then insurance will cover the remainder.

Collision can pay for claims such as sustaining damage from a pot hole, rolling your car, backing into a parked car and hitting a mailbox. Collision coverage makes up a good portion of your premium, so analyze the benefit of dropping coverage from vehicles that are 8 years or older. Drivers also have the option to increase the deductible on your Leaf to save money on collision insurance.

Auto liability

Liability insurance provides protection from injuries or damage you cause to a person or their property by causing an accident. This insurance protects YOU against claims from other people. It does not cover damage to your own property or vehicle.

Split limit liability has three limits of coverage: bodily injury for each person, bodily injury for the entire accident, and a limit for property damage. You might see policy limits of 15/30/5 which stand for $15,000 in coverage for each person’s injuries, a total of $30,000 of bodily injury coverage per accident, and $5,000 of coverage for damaged property.

Liability coverage protects against claims such as funeral expenses, repair bills for other people’s vehicles, legal defense fees, attorney fees and court costs. The amount of liability coverage you purchase is your choice, but buy as high a limit as you can afford. California requires drivers to carry at least 15/30/5 but you should think about purchasing higher limits.

The next chart shows why buying low liability limits may not be adequate coverage.

One last thing to lower rates

We covered a lot of ways to shop for Nissan Leaf insurance online. The key concept to understand is the more companies you get auto insurance rates for, the better your chances of lowering your auto insurance rates. You may even find the most savings is with a smaller regional carrier. These smaller insurers may only write in your state and offer lower auto insurance rates than the large multi-state companies such as State Farm, GEICO and Nationwide.

As you prepare to switch companies, it’s not a good idea to buy poor coverage just to save money. There have been many cases where someone sacrificed comprehensive coverage or liability limits to discover at claim time that it was a big mistake. Your goal is to purchase plenty of coverage at the lowest possible cost while still protecting your assets.

Helpful articles

- Understanding Limits and Deductibles (Allstate)

- Who Has the Cheapest Auto Insurance Rates for a Toyota Camry in Chula Vista? (FAQ)

- What Auto Insurance is Cheapest for Single Moms in Chula Vista? (FAQ)

- Who Has the Cheapest Car Insurance Rates for a Ford F-150 in Chula Vista? (FAQ)

- Should I Purchase an Umbrella Liability Policy? (Insurance Information Institute)

- Shopping for a Safe Car (Insurance Information Institute)

- Safety Features for Your New Car (State Farm)